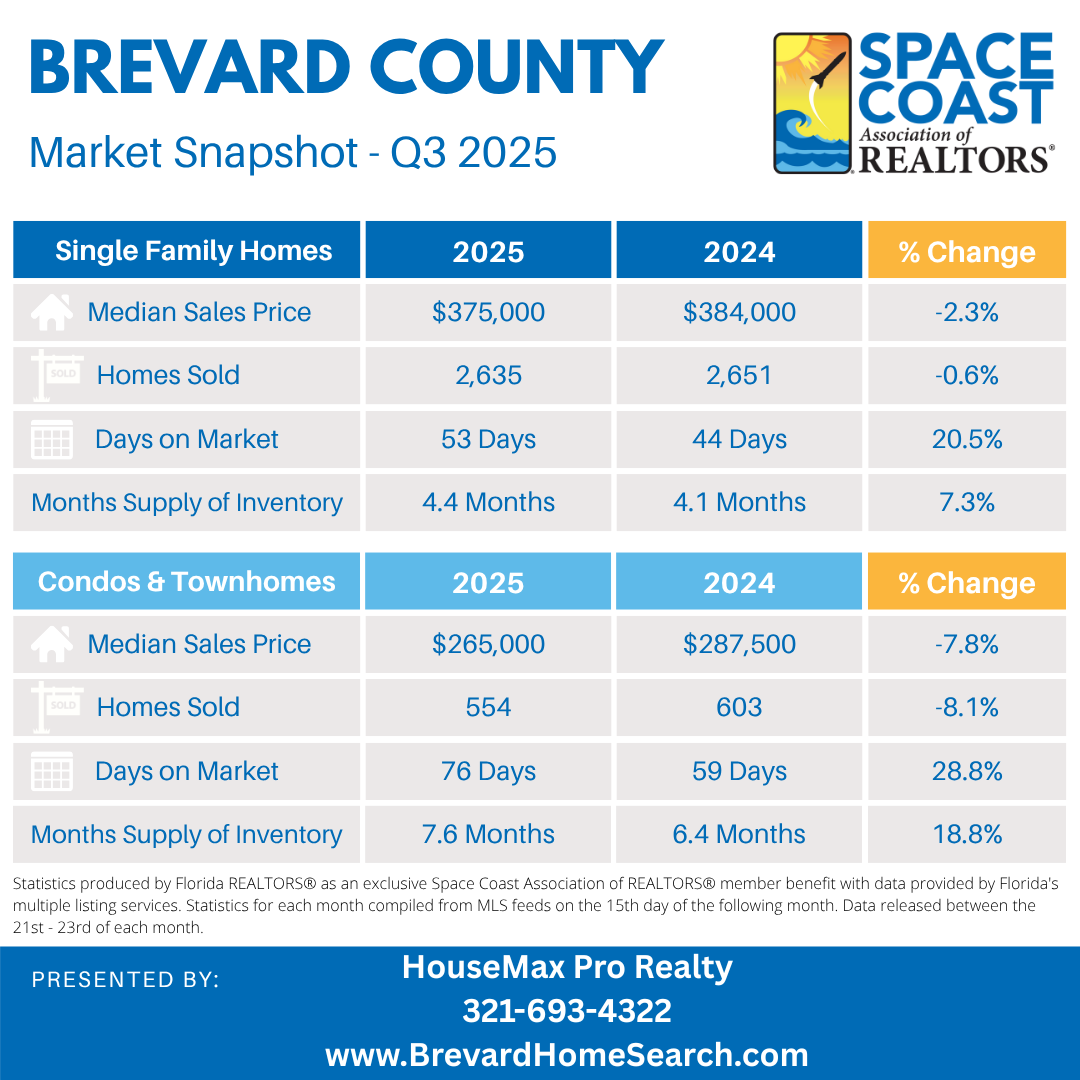

Brevard County, along Florida’s Space Coast, remains a sought-after area for new housing. With its proximity to the Atlantic, beaches, NASA/space industries, growing job sectors, and appealing quality of life, demand stays strong. But the market is shifting — especially in new construction. Builders are adjusting their strategies to adapt to higher costs and cooling buyer sentiment. That means opportunities for buyers.

Glossary: What Buyers See Changing

-

Price Adjustments / Reductions: Builders are lowering list prices or offering “price cuts” on certain inventory or spec homes.

-

Interest Rate Incentives (Rate Buy-Downs, Locked Rates, etc.): To offset rising mortgage rates, some builders (or their lenders) are offering promotional financing, rate buy-downs or locking in lower rates for a period.

-

Other Incentives / Perks: These include closing cost assistance, upgrades (appliances, floors, patios, etc.), lot premium waivers, flex cash, or builder credits.

What the Data Shows in Brevard

Here are some concrete numbers and examples from Brevard County:

-

Median and Starting Prices

New homes listed in Brevard have a median listing price around $330,000. (Realtor)

Homes in certain new-construction developments start much lower — in the low $200,000’s.

-

Price Reductions in Listings

On Zillow, many new construction homes in Brevard are marked with price cuts. Examples:

• A 4 bed 3 bath in Palm Bay was reduced by around $6,000. (Zillow)

• Another home in Palm Bay dropped by ~$24,900. (Zillow)

-

Incentives & Interest-Rate Relief

• Some listings offer a “locked in reduced rate” or seller-paid rate relief mechanisms. For instance: “$15,000 buyer’s incentive OR this house comes with a locked in reduced rate as low as 4.99% APR.”

-

Affordable New Homes Are Still Present

There are numerous new homes in Brevard under $400,000. (Jome) Some starting points are as low as ~$233,780 and rising depending on size, location, and upgrades. (New Home Source)

-

Purchase Assistance Programs

For eligible buyers, local government runs programs:

• Brevard County’s Purchase Assistance Program helps very low, low & median-income families, and it can be applied toward new homes among other units. (Learn More)

• There are income limits, good‐faith contribution minimums, and requirements such as being first time homebuyers. (Learn More)

Why Builders Are Offering More Incentives Now

Some of the forces behind what we’re seeing:

-

Mortgage Rates & Affordability Pressure

As interest rates have gone up, monthly payments increase. To make homes move, builders are more likely to offer rate buydowns or locked incentives to reduce the financial burden for buyers.

-

Inventory / Competition Among Builders

With many new communities in development, builders compete not just against each other, but also with resale homes. To stand out, they sweeten the deal.

-

Cost Pressures & Buyer Hesitancy

Construction costs, materials, labor, permitting etc. continue rising. But buyer demand is a bit more cautious than earlier in the pandemic/boom period. That tension is pushing builders to both manage their margins and appeal more aggressively to buyers.

-

Regulatory / Local Policy Support

Programs like the county purchase assistance help enable buyers to participate. These partnerships can help builders sell more quickly.

What Buyers Should Watch Out For

If you are considering buying a new construction home in Brevard:

-

Read the fine print on incentives

Some rate-buydowns are temporary, or only for a short period. “Locked in rate” sometimes means for an initial period and then adjusts. Confirm duration and conditions.

-

Check which homes are inventory vs pre-construction

Move-in ready homes sometimes receive price cuts; pre-construction deals may promise incentives, but delivery might be many months away. Things can change.

-

Look at total cost, not just price tag

Consider lot premiums, homeowners association (HOA) fees, insurance (especially for coastal areas or flood zones), property taxes, maintenance costs.

-

Use local purchase assistance when eligible

The Brevard County program can help with down payments/second mortgages (zero interest sometimes) if you qualify. (Default)

-

Compare financing options

Even with builder‐offered locked or reduced rates, it’s wise to get quotes from independent lenders to see what’s better over the long run.

Bottom Line

New construction homes in Brevard County are still very much available, with a good range from lower cost spec homes (low $200,000’s) to higher-end luxury new builds. Because of interest-rate pressures and increased competition, many builders are offering more incentives than in recent years. For buyers who are ready, informed, and who qualify for programs, now can be a favorable time to negotiate or find value.

If you’d like, I can pull listings from specific areas like Palm Bay, Titusville, or Cocoa, showing which homes have the best incentives right now. Do you want me to put that together for you?

<><><><><><><><><><><><><><>

💯For a Free List of all new construction homes in Brevard, many with incentives, visit https://NewHomesBrevard.com. |