DeSantis Proposes Plan to Eliminate Property Taxes for Florida Homeowners

The Space Coast Spotlight

Archives

DeSantis Proposes Plan to Eliminate Property Taxes for Florida Homeowners

SIGN UP FOR OUR NEWSLETTER

DeSantis Outlines Plan to Eliminate Property Taxes for Florida Homeowners |

Governor Proposes Constitutional Amendment to Abolish Property Taxes on Primary Residences |

Florida Governor Ron DeSantis has unveiled a bold initiative aimed at eliminating property taxes on primary residences across the state.

Speaking on a national news program, DeSantis highlighted the financial strain that local property taxes impose on homeowners, stating, "People are being pinched across the economy in a lot of things."

He emphasized that while the state maintains fiscal health, local property taxes continue to burden residents.

The governor criticized local governments for excessive spending, leading to increased tax burdens on citizens.

He questioned, "The reality is these local governments have overspent, and people are paying more and more for that. And at some point it's like, when is enough, enough?"

DeSantis's proposal aims to completely eliminate property taxes for homesteaded residents, potentially making Florida the first state to do so while also lacking a state income tax.

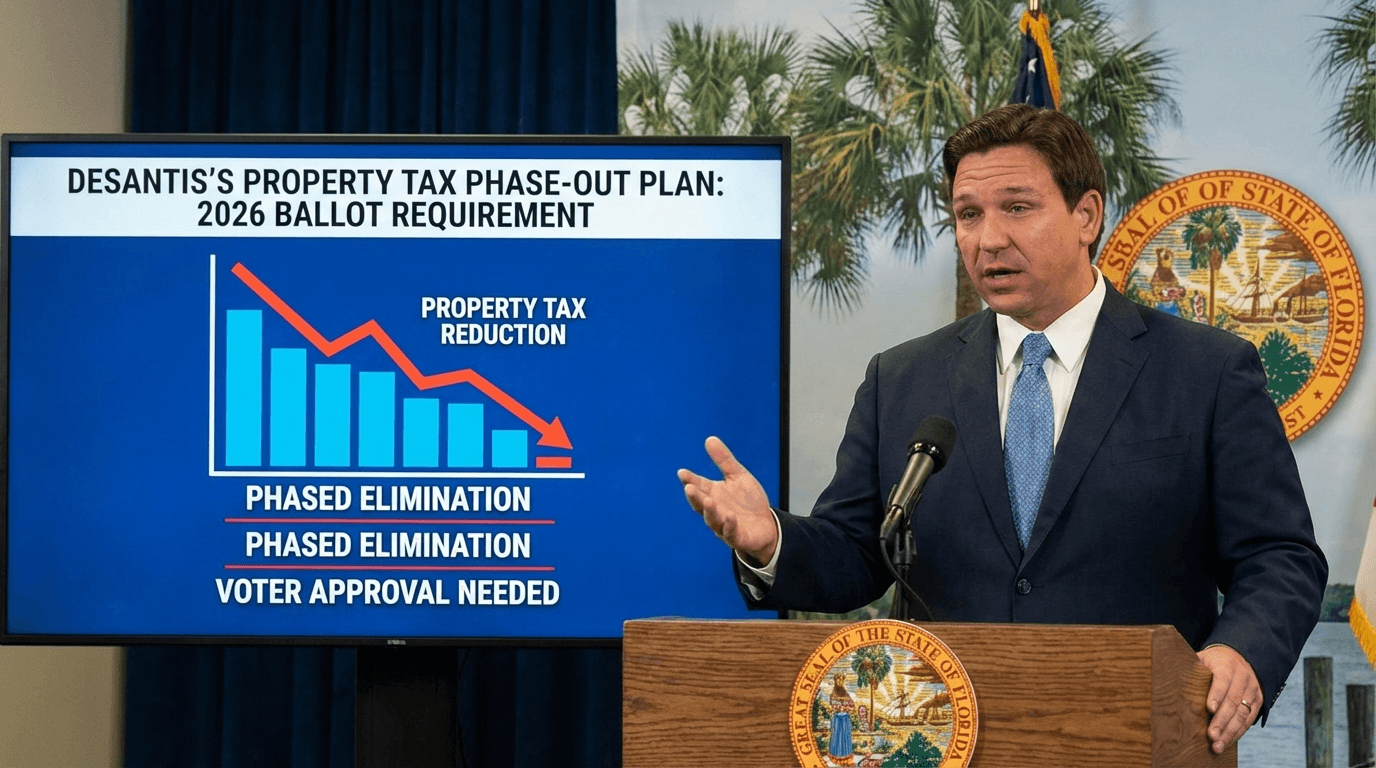

To achieve this, a constitutional amendment would be required, necessitating approval from at least 60% of voters in the 2026 ballot.

In the interim, the Florida House is considering a package of proposals, including a $500,000 homestead exemption (with a potential maximum of $1 million for seniors), a cap on assessment increases, and the option of eliminating property taxes on homesteads altogether.

However, the Florida Policy Institute (FPI) warns that property taxes generate approximately $55 billion annually, accounting for about 18% of county revenues, 17% of municipal revenues, and up to 60% of school-district funding in many areas.

Eliminating these taxes could necessitate significant increases in other revenue sources, potentially raising the state sales tax from 6% to as much as 12%.

DeSantis acknowledged the need for a phased approach and emphasized the importance of voter support.

He stated, "Now, you may have to phase it in; there's gonna be things we're gonna do. We're sensitive to all that. I want something that can work, and I want something that can pass."

The governor also noted that local property tax revenue has risen significantly since 2019, providing the state with the ability to substantially increase its rainy-day fund.

He pointed out, "Think about it – can you have a situation where every five or six years you're increasing budgets 50, 60%? Now, part of it was, we did have a boom with COVID, everyone was rushing to Florida, which caused property values to go up."

DeSantis expressed concern over rapidly increasing property valuations leading to higher taxes, questioning the fairness of such assessments.

He remarked, "But how is it that you buy a home for $350,000 and then, four years later, they tell you it's worth a million dollars and you gotta pay more in property tax? It's not right."

As the debate continues, Florida residents await further developments on this significant proposal that could reshape the state's tax landscape. |